NEW DELHI:

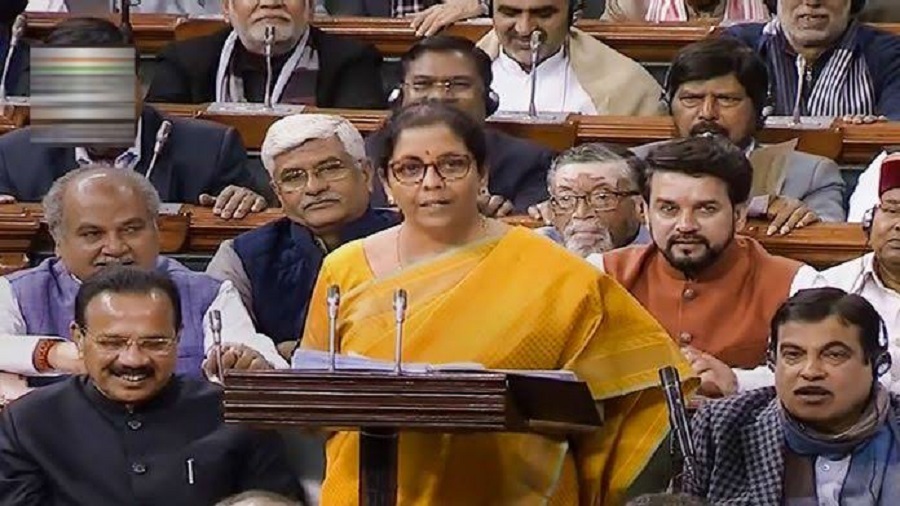

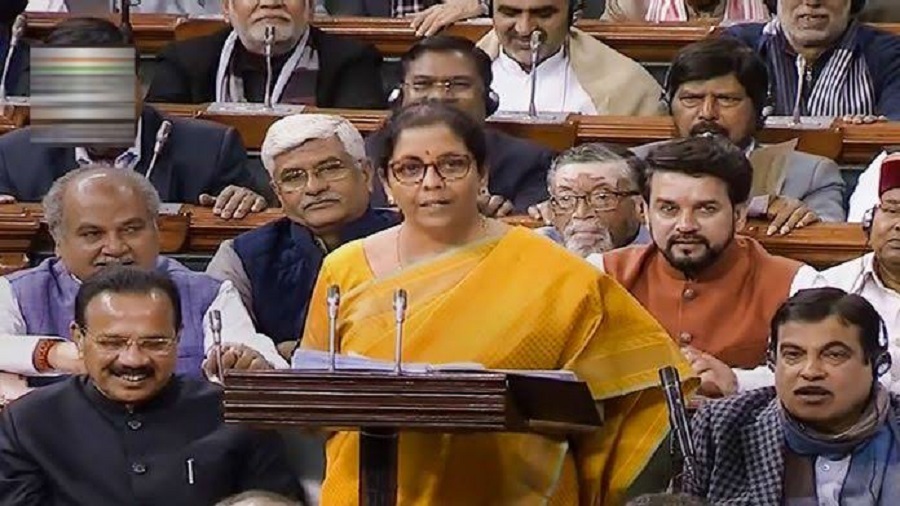

With experts terming the new tax regime complex and unavailing, Finance Minister Nirmala Sitharaman said the new structure will definitely benefit taxpayers in certain brackets, and more clarification will be issued by the government, if needed.

Soon after the announcement of new income tax regime, the government on Saturday evening came out with a list of exemptions applicable for taxpayers switching to the new tax system.

“Last night one set of clarificatory notes was released, today there will be more. That the new scheme will eventually result in people paying more than in the old scheme, why would I come with such a system,” Sitharaman said here.

She defended the new scheme by saying that it will benefit some taxpayers falling in certain brackets, if not all.

” because the income cuts are deeper in the new scheme, we believe a taxpayer from a particular income bracket will be much better off coming into the new system. And the new system, however much I repeatedly say has no exemptions, there are some exemptions that we have allowed in the new system also,” she said.

Industry experts, however, said that two tax regimes with optionality for personal tax, as in case of corporate taxes, only make the structure more complicated.

“With the optional new regime, taxpayers will have to evaluate what works better for them. Those committed to long-term savings and investing via 80C may be discouraged and this may likely de-motivate them from investing in tax-saving asset classes,” said Archit Gupta, founder of Cleartax.

Biocon CMD Kiran Mazumdar Shaw tweeted that removal of exemptions and DDT will hurt individual tax payer and affect consumer spending. Ajit Mishra of Religare Broking said the widely expected personal income tax cuts have come in with lots of caveats, leaving no major impacts.

The government on Saturday introduced new tax slabs with reduced rates for an annual income of up to Rs 15 lakh for those foregoing exemptions and deductions under a simplified tax regime. The new income tax system is optional and a taxpayer can choose to remain in the existing regime with exemptions and deductions.

It is to be noted that once the option to opt for new tax regime is exercised, it will remain valid for subsequent years.

“In order to provide significant relief to the individual taxpayers and to simplify the Income-Tax law, I propose to bring a new and simplified personal income tax regime wherein income tax rates will be significantly reduced for the individual taxpayers who forgo certain deductions and exemptions,” Sitharaman said in her Budget Speech.

Under the new tax proposal, people with an annual income of up to Rs 2.5 lakh will not have to pay any tax. For income between Rs 2.5 lakh to 5 lakh, the tax rate (as earlier) is 5 per cent.

Further, those with an income of Rs 5 lakh to Rs 7.5 lakh will have to pay a reduced tax rate of 10 per cent; between Rs 7.5 lakh and Rs 10 lakh 15 per cent; between Rs 10 lakh and 12.5 lakh 20 per cent; between Rs 12.5 lakh and 15 lakh 25 per cent; and above Rs 15 lakh 30 per cent.

“The new tax regime shall be optional for the taxpayers. An individual who is currently availing more deductions and exemption under the Income Tax Act may choose to avail them and continue to pay tax in the old regime,” the minister had said.

The proposal would lead to a revenue sacrifice of Rs 40,000 crore per annum

more recommended stories

NEW DELHI:Gold and silver prices surged.

AHMEDABAD:Several schools in Ahmedabad were placed.

THIRUVANANTHAPURAM:Prime Minister Narendra Modi on Friday.

DAVOS:Industry leaders and investors from across.

JAMMU:Following a four-day interval since the.

THIRUVALLA:The arguments regarding the bail application.

NEW DELHI:Citizens in 19 states can.

NEW YORK:Zohran Mamdani brought touches of.

KOPPAL:A taluk hospital health officer has.

KOLKATA:The Election Commission of India (ECI).